SiC and GaN - a power walkthrough

With most industries increasing their focus on energy efficiency, both Silicon Carbide and Gallium Nitride are gaining ground in power devices. This article will cover the basics of these materials.

Power semiconductors, also known as power devices or power electronics, are becoming increasingly important as societies and industries invest in green technologies and more energy-efficient solutions. Power devices are essential for controlling and converting electrical energy efficiently and reliably, playing a vital role in various applications, from consumer electronics and industrial machinery to automotive systems and renewable energy infrastructure.

In short, power devices are engineered to handle high currents and voltages with minimal energy loss. They can switch rapidly between on and off states, which is a critical feature for modern high-frequency applications. Moreover, power devices are built to maintain performance and reliability under high thermal loads (high temperatures). Because of this, they can better withstand for example high voltage spikes, ensuring longevity and stable operation in demanding environments.

While traditional silicon-based (Si) power semiconductors laid the foundation for modern electronics, their limitations in high-power, high-temperature, and high-frequency applications have created a demand for advanced materials like Silicon Carbide (SiC) and Gallium Nitride (GaN). SiC and GaN are both classified as wide-bandgap (WBG) semiconductor materials, and they effectively address these limitations.

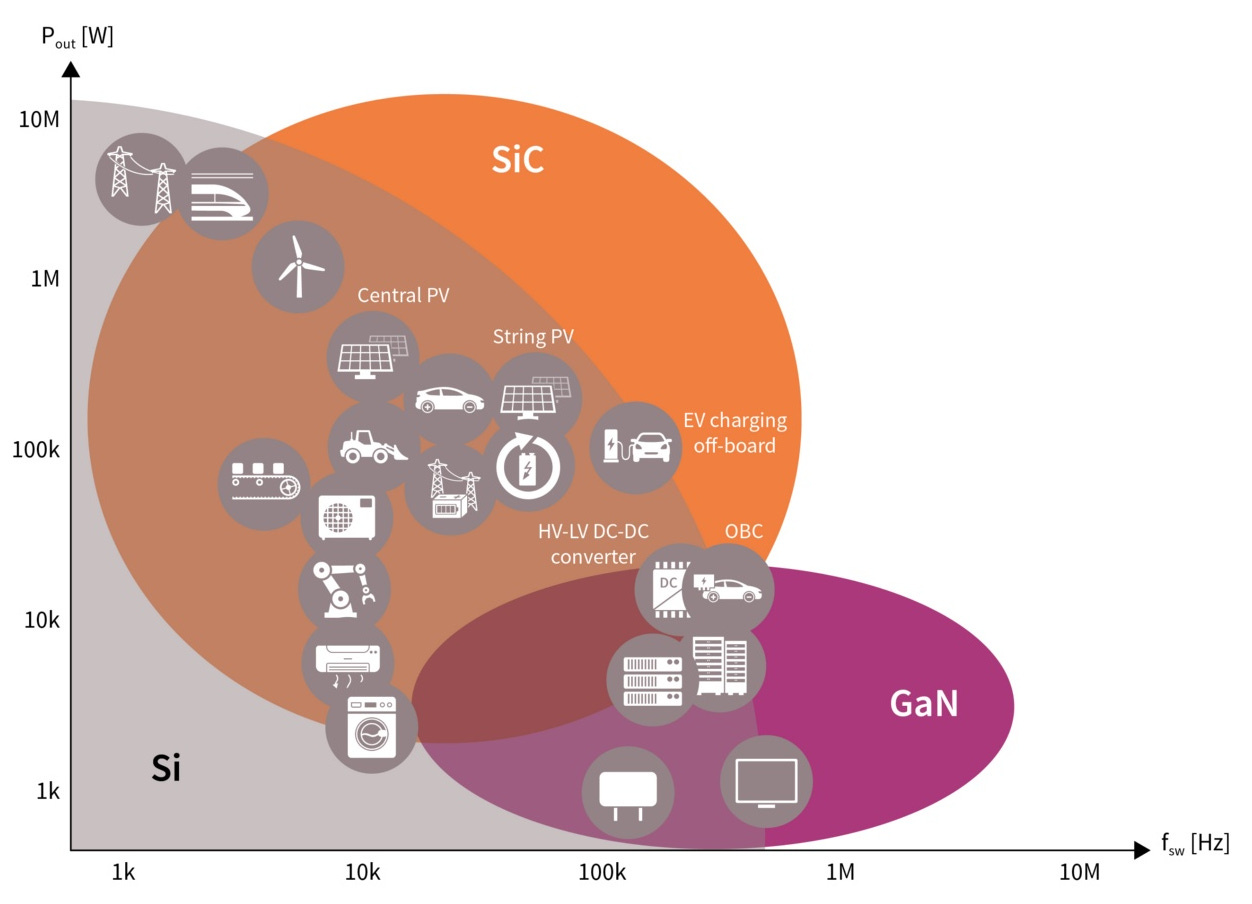

As a result, SiC and GaN power devices have become increasingly popular in applications such as electric vehicles (EVs), EV chargers, solar panels, wind turbines, power adapters, smartphone chargers, and so on. Below is a chart from Infineon showing various emerging use cases for SiC and GaN-based semiconductors, depending on power/voltage requirements (Y-axis) and frequency requirements (X-axis).

Silicon Carbide in the EV industry

In the EV industry, SiC MOSFET (Metal-Oxide-Semiconductor Field-Effect Transistors) inverters are increasingly replacing Si IGBT (Insulated Gate Bipolar Transistors) inverters due to several key advantages. This is particularly true for applications demanding 1,200V, and above. SiC inverters offer lower switching and conduction losses compared to Si IGBTs, which translates into more efficient power conversion and less energy wasted as heat. Furthermore, they reduce the need for complex cooling systems, contributing to lighter and more compact vehicle designs. On the road, SiC inverters provide 10-15% extra range for EVs.

For readers wondering what an inverter is, it is a device that changes direct current (DC) electricity into alternating current (AC) electricity.

Imagine a river that flows in one direction, constantly moving water from point A to point B. This is how DC works, a steady one-way flow of electricity. Now, think about the electricity in your home. It is more like the tide in the ocean (AC electricity), which moves back and forth, coming in and going out. This AC electricity is what most household appliances and electronics use.

An inverter is like a sophisticated pump system that can take the one-directional flow of the river and convert it into the back-and-forth motion of the tides. In more practical terms, an inverter takes the DC electricity from sources like batteries or solar panels and converts it into AC electricity, which is then consumed by most of our home equipment.

In EVs specifically, inverters play a crucial role by converting the DC electricity from the car's battery into AC electricity to power the electric motor, which drives the car's powertrain and makes the car move.

SiC MOSFET inverters can also handle higher voltages and temperatures, providing greater reliability and performance in demanding conditions. They can operate efficiently at temperatures above 200°C, whereas Si IGBTs are typically limited to around 150°C.

Gallium Nitride for charging applications and the EV industry

Have you ever wondered why your new smartphone charges much faster than your previous one did, despite it having a larger battery capacity? Well, now you have the answer! Typically, GaN chargers are more efficient than traditional silicon-based chargers because they generate less heat and waste less energy, resulting in both faster charging times and reduced power consumption. Furthermore, due to higher efficiency and better thermal management, GaN components can be very small and compact, which in turn allows manufacturers to design smaller, lighter, and more portable chargers.

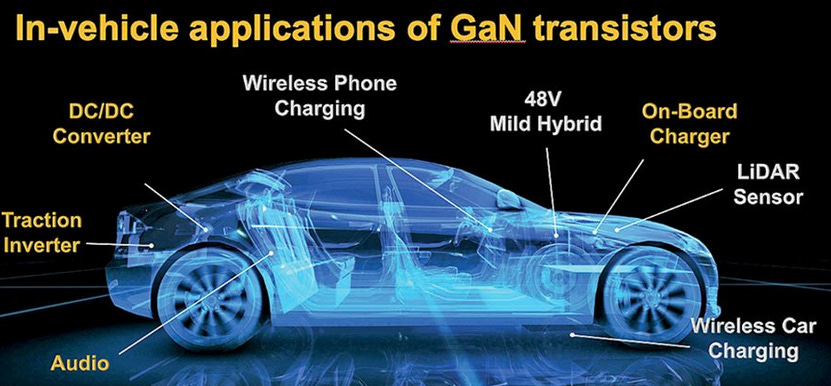

Within the EV industry, GaN enables for example more efficient and compact onboard chargers (OBCs). These chargers convert AC power from the grid into DC power to charge the vehicle's battery. Additionally, GaN is used in DC-DC converters within EVs. These converters manage the power distribution from the high-voltage battery to lower-voltage systems such as the infotainment system, lighting, and other electronic components.

Last but not least, GaN-based LEDs can also be used in vehicle lighting systems, including headlights, taillights, and interior lighting.

SiC vs. GaN

Both SiC and GaN are materials with a promising future. However, there are a number of differences to take into consideration when comparing them. First and foremost, while SiC has a breakdown limit of several hundreds of voltages above 1,200V (1,700V in commercial applications), GaN currently tops out at 650V in commercial applications (but work is currently being done to increase this limit). Additionally, when GaN breaks down with over-voltage, it does so catastrophically. SiC on the other hand, has an over-voltage avalanche rating and thus the ability to survive up to a specified energy limit.

Avalanche rating refers to the ability of a semiconductor material (such as SiC) to withstand a certain amount of energy during an over-voltage condition without failing catastrophically. For SiC, this process involves the material absorbing excess energy and dissipating it, often as heat, up to a specified energy limit. This controlled process allows the device to survive transient over-voltage events without immediate destruction.

In general, SiC is considered a superior material when it comes to high-temperature and high-voltage applications, such as high-power inverters. In some advanced applications, SiC devices can reach breakdown voltages of 3,300V or even higher, depending on their design.

GaN on the other hand, is considered superior when it comes to power density, where power density refers to the amount of power that can be handled per unit area or volume. This is particularly handy when there is a need for small device designs.

SiC is the near-term winner

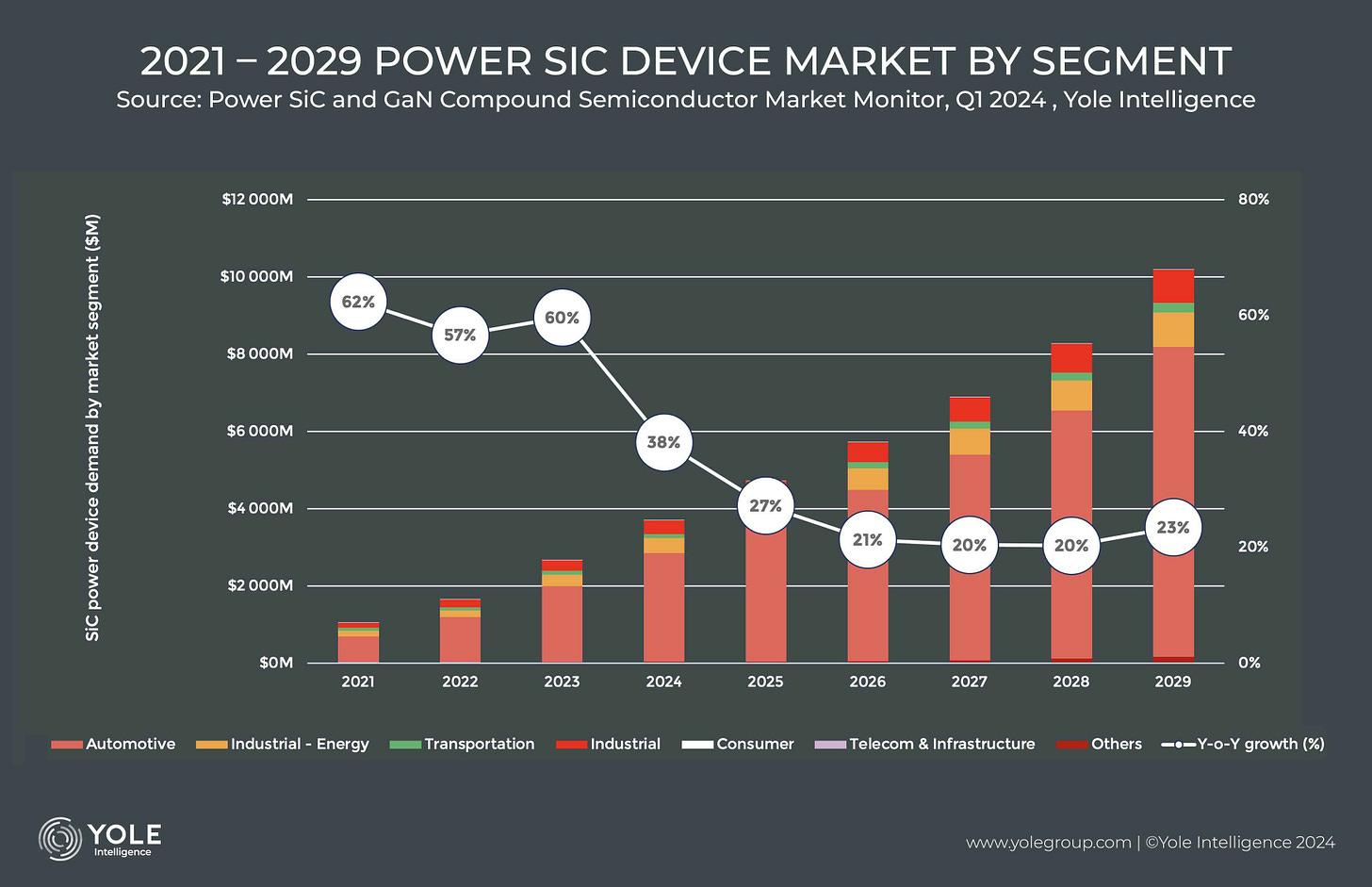

Yole Group, a market research firm specialized in semiconductors, predicts that the total SiC device market will reach a value of $10 billion by 2029. As displayed in the chart below, automotive is expected to be the main driver for near-term SiC growth.

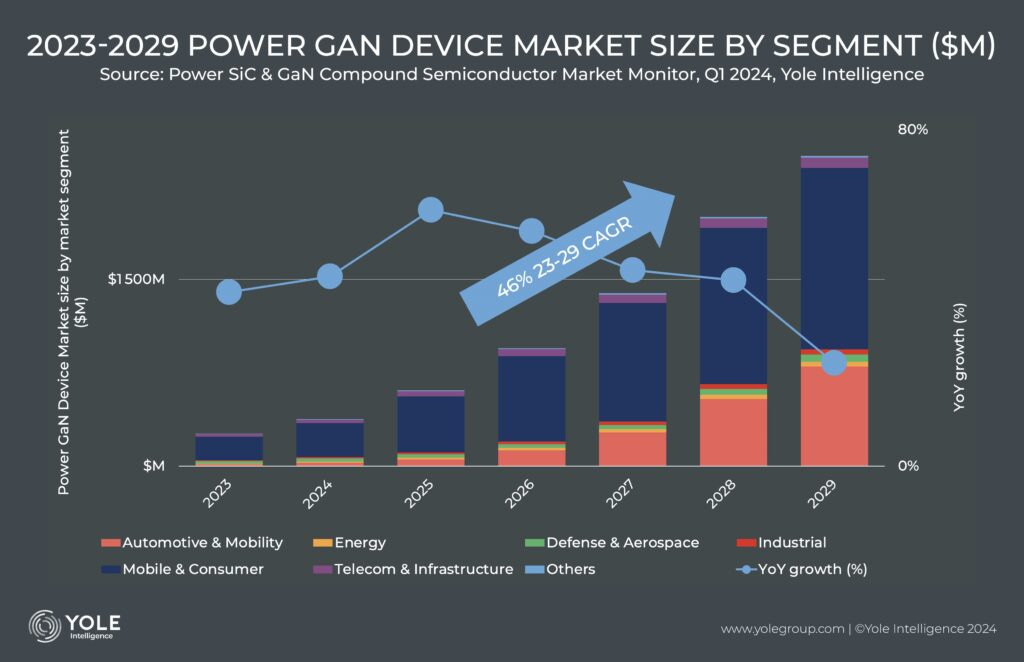

The total GaN device market is predicted to reach $2.5 billion within the same time frame. GaN is clearly lagging SiC within the automotive industry, but will at some point in time start to gain ground. Right now however, as shown in the chart below, GaN growth is primarily driven by the mobile and consumer market.

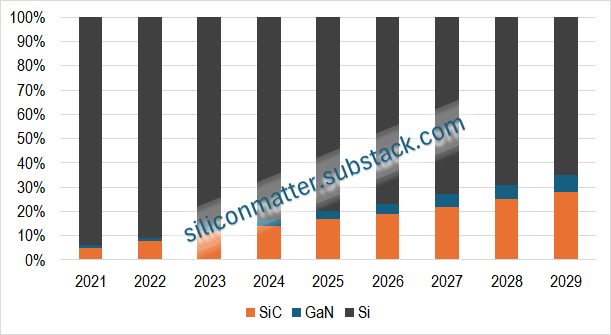

Below is a chart that visualizes the total power device market, split by material (Silicon Carbide, Gallium Nitride and Silicon).

As illustrated in the above chart, the path to widespread dominance for SiC and GaN in the power device market is lengthy. Compared to Si, SiC material and devices are significantly more expensive and complex to produce and process. SiC wafers are, for example, 5-10x more expensive compared to silicon wafers. The higher price is further amplified by additional costs related to epitaxial growth of high-quality SiC device layers on substrates. Consequently, SiC is expected to gain traction primarily in applications where its unique properties, such as high temperature and high voltage tolerance, are critical.

When it comes to SiC epitaxial growth, I would suggest readers to have a closer look at Aixtron. Their G10-SiC system is particularly notable for enabling high-volume production of SiC epitaxial wafers. The G10-SiC system supports both 150mm and emerging 200mm SiC wafer sizes.

Companies with high and/or growing exposure to SiC and GaN

With both SiC and GaN still remaining as emerging materials/technolgies, there are plenty of opportunites for long-term investors. Companies with a decent exposure to SiC and GaN include (but are not limited to):

Infineon: Infineon is the global leader in power semiconductors and power systems. In 2022, the company held a 21% market share of power semiconductors and modules.

onsemi: onsemi is a leading semiconductor manufacturer with extensive lexpertise within advanced MOSFETs and Silicon Carbide. In 2023, onsemi shipped SiC products worth $800 million (10% of its revenue mix) and achieved the highest SiC revenue growth in the industry. In 2022, the company held a 9% market share of power semiconductors and modules.

STMicroelectronics: STMicroelectronics offers one of the industry's broadest product portfolios. In 2023, 20-25% of its revenue came from power- and discrete products.

Wolfspeed: Wolfspeed is a manufacturer of wide-bandgap semiconductors and materials. The company is a silicon carbide and gallium nitride pure-play and has built the world's first, largest, and only 200mm Silicon Carbide fab.

Aixtron: Aixtron is a multinational technology company, specialising in manufacturing metalorganic chemical vapour deposition (MOCVD) equipment. Their equipment is then used in fabs, such as Wolfspeed’s. Equipment aimed at power electronics, including SiC and GaN, represented 75% of Aixtron’s 2023 sales.

Aehr Test Systems: Aehr Test Systems is the leader in wafer level burn-in for silicon carbide (SiC), gallium nitride (GaN), optical photonics, and memory integrated circuits. Onsemi is among its SiC customers.

X-FAB: X-FAB is the first pure-play foundry to provide comprehensive processing technologies for wide-bandgap materials like SiC and GaN. SiC represented 8% of X-FAB’s 2023 sales, with a year-over-year growth of 33%.