X-FAB: An overlooked company facing doubts over its ongoing expansion

X-FAB is a semiconductor foundry focused on automotive, industrial, and medical sectors. Despite market doubts, its investments in capacity expansion positions it for potential long-term growth.

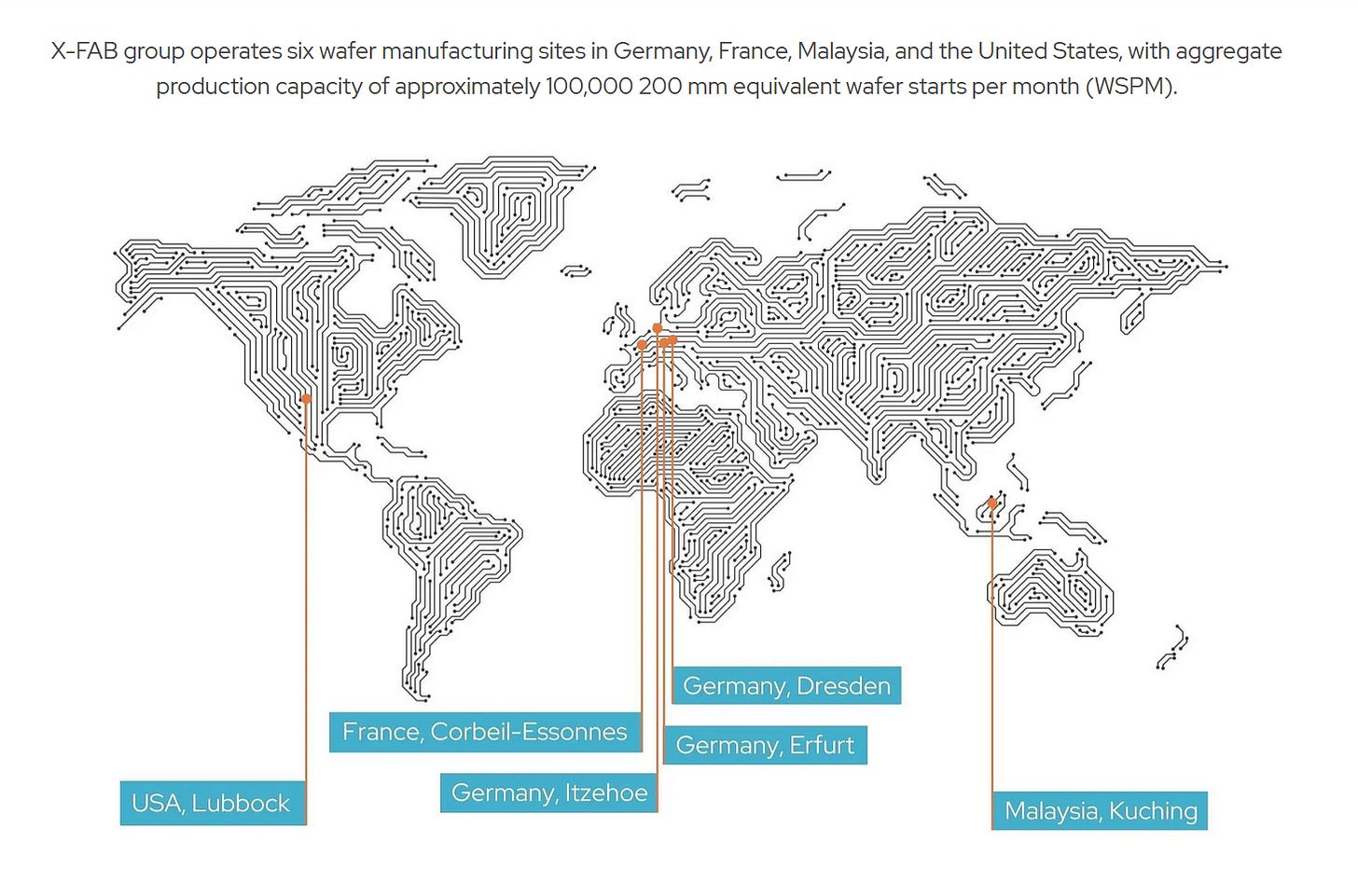

X-FAB ($XFAB) is an interesting, but relatively small, semiconductor foundry headquartered in Europe. As illustrated in Figure 1 below, X-FAB not only operates in Europe, but also has facilities in the United States and Malaysia. The company’s current market cap is $800 million at a stock price of €5.40 – which emphasizes its relatively small size.

For those unfamiliar with what a foundry business is, it can be described as a contract manufacturing business for semiconductors. What X-FAB does, is take a bare silicon wafer and process it through 500-1,000 manufacturing steps based on customer specifications and blueprints. The typical production process at X-FAB involves 10-55 masks (stencils), and it takes 30-120 days to complete each wafer.

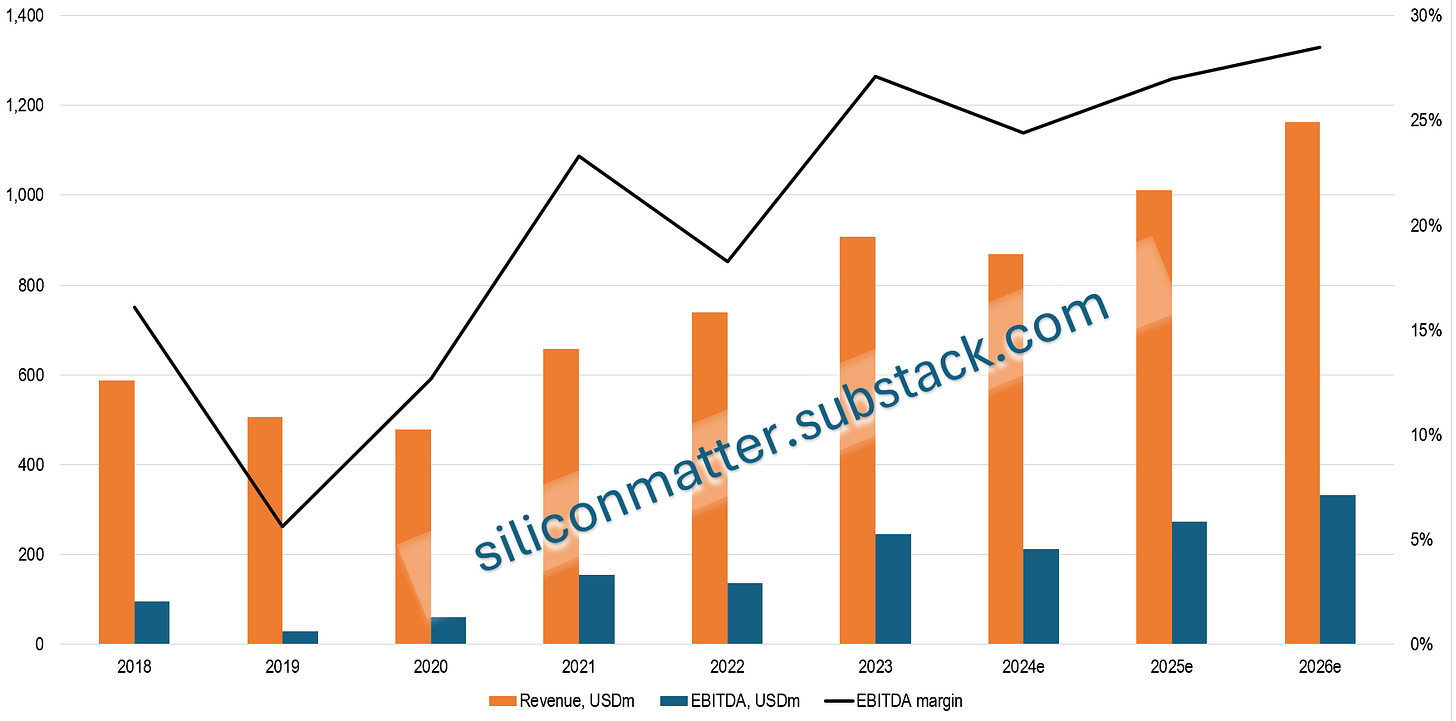

In 2023, X-FAB generated revenue of $907 million, with an EBITDA margin of 27% (EBIT margin of 17.5%). CMOS chips accounted for 81% of revenue, MEMS for 11% and SiC for 8% (up from 5% of sales in 2021).

Chart 1 below illustrates X-FAB’s revenue and EBITDA trends since 2018, along with SiliconMatter’s projection for the years to come.

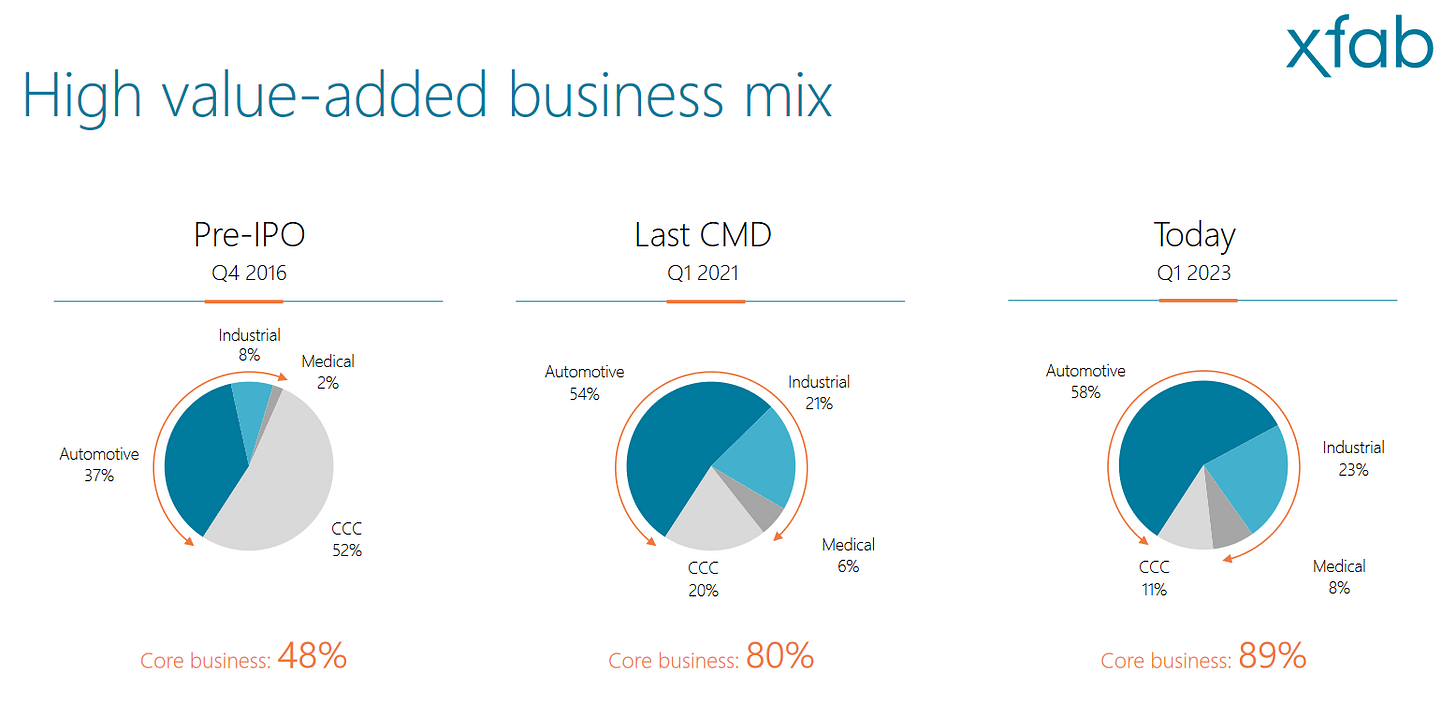

Following the company’s decision to pivot away from the consumer segment (“CCC”), deeming it “non-core”, and concentrate instead on the automotive, industrial, and medical sectors, there has been a noticeable change in growth trajectory and profitability since 2020.

As shown in Chart 2 below, X-FAB has significant exposure to automotive and industrial applications, with these sectors comprising approximately 90% of its core business revenue. However, the company has expressed clear ambitions to expand its medical segment, which has grown its share of core business revenue from 4% in 2018 to 8% today.

It's important to note that, unlike companies like TSMC, the capital expenditure required for X-FAB to operate in the automotive, industrial and medical segments is significantly lower than that needed for cutting-edge logic segments, such as AI applications and mobile consumer devices. As depicted in Figure 3 below, X-FAB specializes in chip manufacturing on mature process nodes. Between 2018 and 2021, X-FAB's capital intensity typically ranged between 10-15%. Going forward however, after X-FAB’s current investment phase, management expects an annual capital intensity of between 15-20%.

In the automotive segment, X-FAB supports a wide range of applications. Figure 4 below illustrates the types of chips that X-FAB manufactures for use in vehicles. For instance, modern high-end electric vehicles can be equipped with up to 180 chips produced by X-FAB.

Applications in the industrial segment include industrial robotics, power supply systems, renewable energy, and transportation. In the medical segment, X-FAB produces chips for pacemakers, DNA sequencing, and cochlear implants. Most of these segments offer a high-growth potential.

Although the automotive and industrial segments are cyclical by nature, X-FAB’s engagement in these markets is compelling due to their long product lifetimes. On average, the product lifetime for the applications X-FAB supplies exceed 12 years. The product lifetime distribution shown in Figure 5 below, implies that once a chip is designed and X-FAB secures the business, a prolonged revenue stream can be expected.

Customer concentration

In total, X-FAB serves over 400 customers. It is, however, important to point out one of them. Melexis ($MELE) is one of X-FAB’s largest customers, and could be viewed as a more or less strategic business partner. As shown in Figure 6, both companies' key stakeholders share a mutual interest, highlighting the significance of their business relationship.

In 2023, Melexis contributed to 40% of X-FAB’s revenue, down from 55% in 2018 and 47% in 2022. While Melexis remains a key strategic business partner, X-FAB is actively working to further diversify its customer base.

Despite this diversification effort, the strong business relationship with Melexis continues, with Melexis supporting X-FAB's ongoing capacity expansion (details on this expansion will be discussed later) through prepayments, driven by its future chip demand. The two companies have also signed extensive LTAs (long-term agreements).

Below are two additional quotes from Melexis regarding their business relationship with X-FAB:

To further emphasize the business relationship between the two companies, Melexis is currently investing in their Kuching facility, which is located right next to X-FAB's plant.

Investing in future growth

As illustrated in Figure 7, X-FAB is currently in a significant investment phase, aiming to scale up production and drive future growth. Between 2023 and 2025, the company plans to invest $1.0 billion in capacity expansion and $0.2 billion in maintenance capex, a substantial increase from its historical annual capex of $50-100 million. As a result, X-FAB’s net cash position of $145 million at the end of 2023 is expected to shift to a net debt position of $330 million by the end of 2026, equivalent to 1.3x its 2023 EBITDA.

Through the ongoing investments, X-FAB aims at increasing its annual revenue from $900 million in 2023 to $1.5 billion by 2026. Of the anticipated $600 million incremental revenue growth, the SiC segment is expected to contribute by $220-270 million in added annual revenue.

As shown in Figure 8 below, X-FAB plans to add in total 49,000 wafer-starts per month through its current capacity expansion plan across all of their facilities. During the most recent Q2 conf-call, management mentioned that:

“200-millimeter CMOS lines, especially those producing the high-demand 180-nanometer technologies were running at full load.”

The timing of X-FAB’s CMOS capacity expansion can therefore be seen as well planned.

Market verdict, no bueno?

Judging by how the market currently is valuing the company, there appears to be little to no confidence in X-FAB’s expansion plan. However, if applying a grain of salt to the company’s near-term growth expectations given the currently depressed SiC and industrial segments (which would also reduce overall capex), it seems more than reasonable to anticipate that 2026e revenue actually could approach $1.2 billion. This projection assumes SiC revenue of around $170 million, compared to $80 million over the past twelve months, and their ambitious target of $300-350 million by 2026.

If X-FAB reaches approximately $1.2 billion in total revenue by 2026, with an EBITDA of $330 million, it would result in an EV/EBITDA valuation of 3x and an EV/EBIT valuation of 5.5x. Starting in 2028, the company’s free cash flow will enable rapid de-leveraging following the investment phase, particularly once prepayments have been cleared from the balance sheet, no longer impacting cash flows.

If the company reaches $1.2 billion in revenue by 2026e, reflecting a 10% sales CAGR and an 11% EBITDA CAGR, it is reasonable to assume that the valuation could expand to an EV/EBITDA multiple of 5-6x and an EV/EBIT multiple of 8.5-10x, especially considering the potential for strong free cash flow generation. These valuation assumptions are based on multiples that the market applied to the company before the cyclical downturn in the industrial and EV segments.

Below, in Figure 9, NTM EV/EBITDA is displayed for X-FAB (orange line) and several sector peers. Most noticeable is how X-FAB’s and UMC’s valuation has diverged quite significantly since last year.

An EV/EBITDA multiple of 5-6x 2026e would result in an enterprise value of $1.7 to 2.0 billion and a market cap of $1.4 to 1.7 billion, compared to today’s market cap of $800 million.

At $1.5 billion in annual revenue (assuming that the company reaches its expansion target), X-FAB expects an annual EBITDA of $500 million (EBITDA margin of 30%) and annual capex of $280 million (a capital intensity of 18.5%). This would result in an underlying annual FCF generation of approximately $200 million. Even if applying a 2.5 percentage point lower EBITDA margin (i.e. 27.5% versus the target of >30%), it would result in an annual FCF generation of $110 million. With such future FCF generation and FCF-yield (10% at an enterprise value of $1.2 billion), EV/EBITDA 3x could be viewed as cheap.

EV market growth and SiC growth – is it really over?

With this year’s news flow of a slowdown in global EV growth (particularly in Germany/Europe), the financial market has traded down most stocks with heavy EV and SiC exposure. This has also had an impact on X-FAB, since the company has ambitious SiC growth plans and invests accordingly, albeit at a lower pace than initially planned.

At the same time however, both STMicroelectronics and Onsemi have announced continued and new SiC investment plans, indicating continued confidence in the technology.

In May, STMicroelectronics affirmed their plan for a new high-volume 200mm SiC manufacturing facility for power devices and modules, as well as test and packaging, in Italy. STMicroelectronics will invest up to €5 billion in this plant.

In June, Onsemi announced that it had selected the Czech Republic for a brownfield establishment of an end-to-end vertically integrated SiC and power semiconductor plant. The company will invest up to $2 billion in this plant.

What the market does not seem to fully grasp is that, despite a slowdown in EV growth, SiC penetration within the EV market is continuing to expand. Nearly all OEMs have committed to adapt the technology. Currently, just about 25% of fully electric vehicles are equipped with SiC inverters, and this market share is expected to double by 2035.

If having a look at Quartr’s conference call statistics from companies with silicon carbide exposure (in Figure 10 below), and the terms ”silicon carbide”, ”inventory levels” and ”inventory correction”, it is interesting to note that silicon carbide mentions peaked when the sector sentiment peaked in mid-2023. Moreover, it appears as mentions of “inventory levels” and “inventory correction” may have peaked in H1 2024. It at least indicates that the current market conditions are far from ideal.

To complement the above statistics, it is also interesting to see how the amount of ”recovery” mentions in silicon carbide related conference calls have developed during the past two months. As illustrated in Figure 11 below, it appears that the market recovery could be just around the corner.

Furthermore, as displayed in the Figure 12 below, Melexis (X-FAB’s currently largest customer) sees their addressable EV market to more than double in the coming five years. With X-FAB being one of their key suppliers, it sure looks good for them.

Conclusion

Either X-FAB is being completely overlooked by the market, or there is a complete lack of confidence in their ability to execute their investment plan. Perhaps a combination of both? Regardless, the current valuation of X-FAB could present a compelling risk/reward opportunity for investors who have a bit of patience.

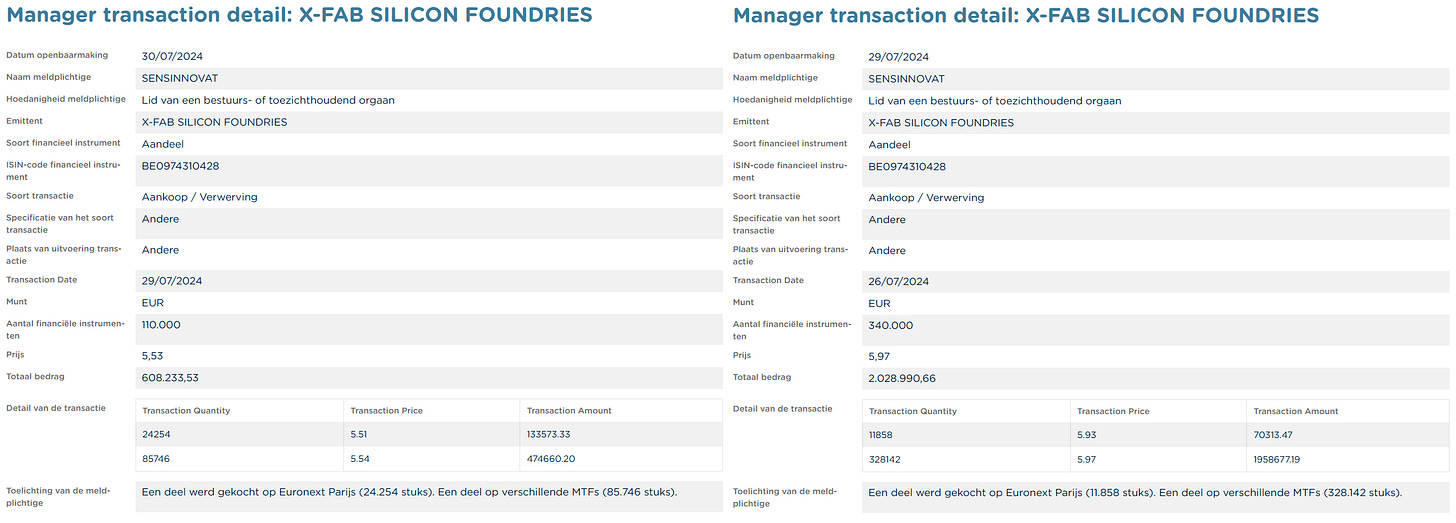

There are definitely risks associated with X-FAB. Those include market risks, customer risks, technology risks and various operational risks. But following the company’s Q2 announcement in July, insiders purchased shares for another €2.6 million (Image 1), signaling that they also view the current valuation as attractive.

*Disclaimer* This article is for informational purposes only and should not be considered or viewed as investment advice. The analysis presented above represents the author's personal opinion and is not a recommendation to buy, sell, or hold any security. The information provided may contain errors or inaccuracies, and the author makes no guarantees regarding its completeness or reliability. Readers are encouraged to conduct their own independent research and consult with their financial advisor before making any investment decisions. The author may hold positions in the securities mentioned and may engage in transactions involving these securities without further notice.